By continuing you agree to eChinacities's Privacy Policy .

Sign up with Google

Sign up with Google

Sign up with Facebook

Sign up with Facebook

Q: China has been opening up for 40 years. Is the door open yet?

I saw an article today that said a new law will make it easier for foreigners to invest. Part of the opening up process.

These new laws appear every week. Easier visas, easier green cards, relaxation of rules.

High end tallent is the key word now.

I dont know anyone who has benifited from these new opening up laws.

Meanwhile, bbc is blocked. Reddit, blocked.

China has not accepted a single asylum seeker.

The door might be opening, but it is a very small door.

After 40 years of opening up, should china be more open by now?

China cannot accept immigrants till they have working limit ![]() of one-child policy.

of one-child policy. ![]()

I'd say, it's too many of them already ...

Japs and EU have an aging population, so they must go for the new blood ...

Opening up? Have you ever reached with R hand to the L pocket going around your butt ...?

Just anything I encountered in China reminded me on that swift in-pocket move.

https://safehaven.com/markets/emerging-markets/Why-China-Will-Outperform...

Why China Will Outperform In The Long Term

By Frank Holmes - Sep 26, 2018, 10:00 AM CDT

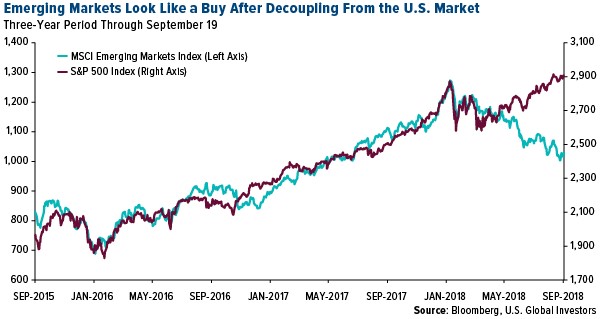

Emerging markets continue to decouple from the U.S. market, making them look attractive as a value play—particularly distressed Chinese equities. Below I’ll share with you two big reasons why I think China is well-positioned to outperform over the long term.

So far this year, the MSCI Emerging Markets Index has given up about 10 percent, mostly on currency weakness and global trade fears. The S&P 500 Index, meanwhile, has advanced roughly 9 percent as a flood of passive index buying pushes valuations up and companies buy back their own stock at a record pace.

(Click to enlarge)

S&P Dow Jones Indices reported this week that buybacks in the second quarter increased almost 60 percent from the same three months a year ago to a record $190.6 billion. For the 12 months ended June 30, S&P 500 companies, flush with cash thanks to corporate tax reform, spent an unprecedented $645.8 billion shrinking their float. In the first half of 2018, in fact, companies spent more on buybacks than they did on capital expenditures.

As I told CNBC recently, this, combined with fewer stocks available for fundamental investing, could contribute toward a massive selloff when it comes time for multibillion-dollar index funds to rebalance at year’s end.

But let’s get back to emerging markets.

The Selloff Is Overdone, According to Experts

Again, China in particular looks like a buying opportunity with stocks down near a four-year low. Speaking with CNBC last week, chief executive of J.P. Morgan Chase’s China business, Mark Leung, said that the emerging market selloff is largely overdone. “If you look at the positioning and also the fundamentals side, we think there are reasons to start going into emerging markets for the medium and long term,” Leung said, adding, “China is a big piece.”

This view was echoed by Catherine Cai, chairman of UBS’s Greater China investment banking arm, who told CNBC that she believes “among all the emerging markets, China’s still representing the most attractive market.”

The U.S. just imposed tariffs on as much as $200 billion worth of Chinese imports, which will have the effect of raising consumer prices. Among the retailers and brands that have already announced they will be passing costs on to consumers are Walmart, General Motors, Toyota, Coca-Cola and MillerCoors. China plans to retaliate with tariffs of its own on $60 billion in U.S. exports.

Related: Gold Exodus To Reverse

Despite this, the tariffs’ impact on the Chinese economy will be “very small,” Cai said, as the country’s government is now “prepared” to handle the additional pressure.

The Power of 600 Million Millennials

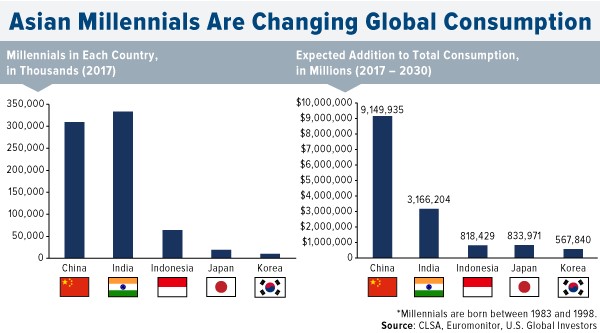

The two reasons I find China so compelling right now are 1) promising demographics, and 2) financial reform.

As for the first reason, there’s really no arguing against the sheer math of Asia’s exploding population. You’ve heard the expression “There is strength in numbers,” and nowhere is that more apparent than in China and India, affectionately known as “Chindia,” where 40 percent of all humans live.

But there’s more. According to a recent report from CLSA, the entire continent of Asia is now home to nearly one billion millennials, or people aged 20 to 34. China and India alone contribute more than 600 million millennials, the youngest of whom will “start to hit their ‘peak’ earning capacity” over the next 10 years, says CLSA.

(Click to enlarge)

“Millennials are more affluent, better educated with difference perspectives and priorities than their parents’ generation, which tends to sacrifice present consumption for the future,” CLSA writes. “Millennials care less about saving.”

This translates into not only the largest consumer class the world has ever seen, but also the most eager to spend their money on goods and services their parents and grandparents could never have imagined.

Consumption, in fact, now accounts for nearly 80 percent of China’s gross domestic product (GDP) growth, helping the country become less dependent on capital input and foreign trade.

China’s Capital Markets Continue to Mature

As for my second reason, financial reform, Premier Li Keqiang recently pledged to give equal treatment to foreign investors in capital markets, all in the name of bolstering confidence among investors who may have been rattled lately by the U.S.-China trade dispute.

“The pool is full of water,” Li said, “and the challenge is to unblock the channels.”

China A-shares, those traded in the Shanghai and Shenzhen stock exchanges, were once available only to Chinese citizens living on the mainland. But as a sign of the financial market’s maturity, last week marked the first time that foreign investors living in mainland China, as well as employees of listed Chinese firms living overseas, could freely trade A-shares.

Many A-shares have already been added to indexes provided by MSCI, and FTSE Russell said it will decide soon whether to do the same.

As we’ve seen in the U.S. market and elsewhere, a stock’s inclusion in a major index has meant, for better or worse, that it automatically gets an infusion of investors’ money, regardless of fundamentals.

That Premier Li plans to open China’s market up even further is exciting, and makes its investment case even stronger.

ambivalentmace:

Yes, the new generation from China will be good consumers going into indentured servitude and debt and spending all the savings of their parents and become another US that serves international bankers, the squeeze is coming, food supplies, debt bombs, factory migration to India, blockade of intellectual theft, inflation, it's going to get ugly in a hurry, they will begging for capital, but nobody will trust them since they have been screwing and stealing from investors for years, It's over, there are very few suckers left that will take the bait.

They made the rules to always win instead of share, and now no one will share with them. Enjoy the show, it's going to be an epoch performance. The hidden secret is privatizing property from the early 90's gave everybody in the country instant equity that did not exist, compared to countries that had private ownership passed down for centuries, this instant equity was rolled into speculation too fast and too quickly, and taking this out of the equation and getting real numbers from economists is impossible because no one has ever done this before so quickly on such a large scale. The whole system depends on growing populations and property growth and the demographics and job squeeze from property being over 40 percent of salaries is going to be a time bomb.

It is an interesting dichotomy, Japan says screw immigration unless it's on our terms, we can get robots to fill the labor void. The rest of the world, bring them all in or fornicate more, we will pay you to have kids and it you don't, we will bring people you don't want and shove them down your throat whether you like it or not, because we need a growing tax base, infrastructure, increase gdp, more power, whatever. If the Japanese are right and the rest of the world is wrong and we are stuck with idle hands not working all over the world, I think wars are the result, not the hunger games and computer game world orgy contests. I hope I am wrong about this, but I am usually not.

ScotsAlan:

When it comes to Japan Ambi, we also need to consider the army of occupation. It is a significant amount of ppl, even if temp. But China and Japan both seem to have ' protect our culture' reasoning when it comes to immigration.

So small business that have seen the mass evacuation of money and capital are going to take a chance and jump into China. Somebody is writing great fairy tales for the captive audience of brain washed believers.